The Sharp Drop in US Imports from China: Tariffs Take a Toll in September 2025

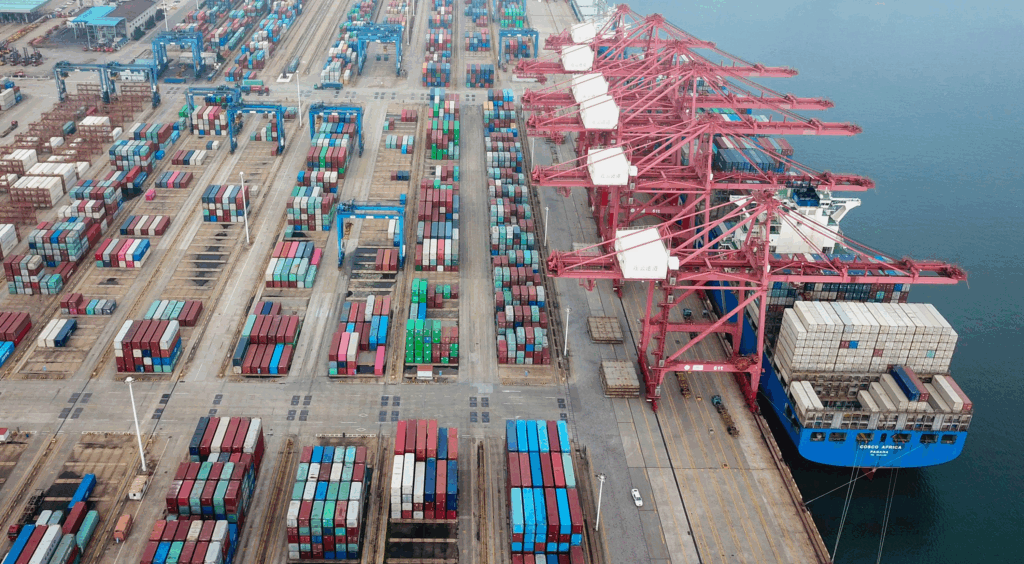

In a sign of escalating trade tensions, U.S. imports from China plummeted 22.9% year-over-year in September 2025, according to fresh data from supply chain analytics firm Descartes. This marks one of the steepest monthly declines since the renewal of the U.S.-China trade war earlier this year, dragging overall U.S. containerized imports down 8.4% to 2.31 million twenty-foot equivalent units (TEUs)—still the third-highest September on record, but a far cry from the peak-season frenzy of prior years.

The culprit? President Donald Trump’s aggressive tariff regime, now averaging 57.6% on Chinese goods and covering nearly all imports. What started with a 10% levy on Chinese products in February has snowballed into broader hikes, including a delayed but looming increase set for November 10 unless negotiations intervene. Retailers, spooked by the uncertainty, frontloaded holiday shipments earlier in the summer, leaving little momentum for late-September arrivals. Categories like furniture, toys, electronics, and machinery—Chinese staples—saw the biggest hits, with imports of upholstered furniture and kitchen cabinets facing fresh 25% duties starting October 14.

This isn’t isolated to the U.S. China’s exports to America have been in freefall, down 33% in August alone and 15.5% for the year through that month. Globally, Beijing is pivoting hard: Shipments to the EU, ASEAN, Africa, and Latin America surged 7.7% to 24.6% over the same period, cushioning the blow and propelling China’s trade surplus toward a record $1.2 trillion. U.S. ports are turning to alternatives—imports from Vietnam, India, Thailand, and Indonesia rose in September—but these shifts can’t fully offset the void, and they’re inflating costs as supply chains reroute.

Economically, the pain is bilateral. American households face an extra $1,300 in annual costs from these tariffs, per Tax Foundation estimates, while Chinese factories grapple with overcapacity and job losses in export-heavy sectors. Yet, for China, the diversification is paying off, building resilient ties with emerging markets. For the U.S., it’s a high-stakes gamble: Tariffs aim to reshore manufacturing, but they’re fueling inflation and slowing global trade growth to a projected -0.2% this year, warns the WTO.

As the 90-day tariff truce ticks down, September’s data underscores a stark reality—without a deal, the decline could deepen, reshaping trade flows for years to come.